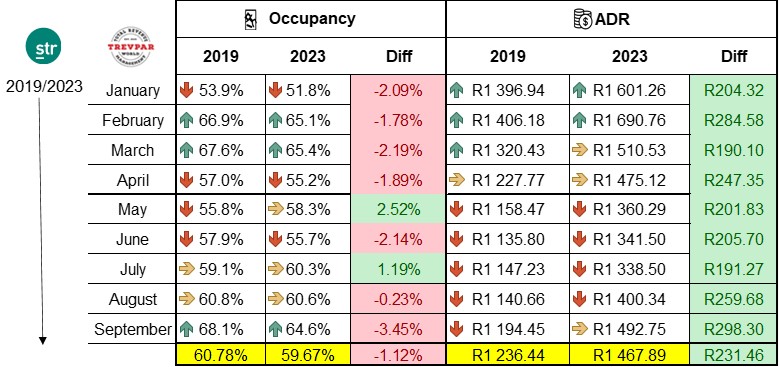

In September 2023, South African accommodations closed on an average occupancy of 64.60% which is 3.45% less than the occupancy of 68.1% achieved in 2019. The September 2023 occupancy grew from 60.30% in 2022 to 64.6% in 2023, despite the year-on-year growth the country wide occupancy is still below pre covid levels.

The average rate achieved in September 2023 was R1 492.75 and has grown by 24.97% on the achieved average rate in September 2019 of R1 194.45. When comparing the achieved average rate for September 2023 to the achieved average rate of September 2022, a year-on-year increase in average rate of 13.47% can be seen, a growth from R1 291.69 to R1 492.75.

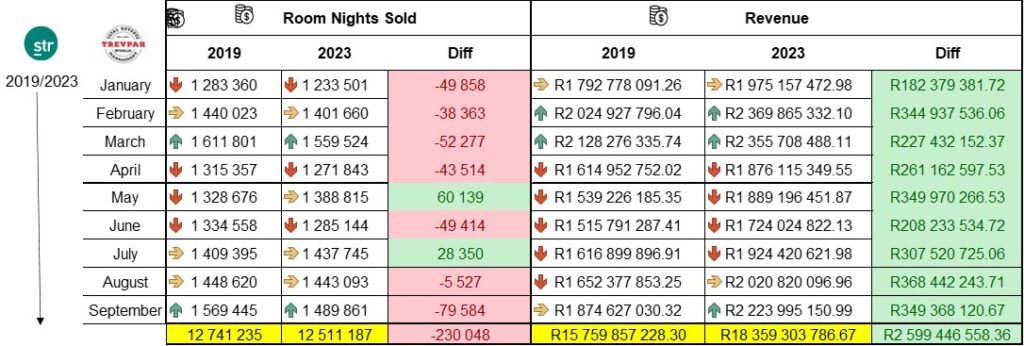

When translating the occupancies into room nights sold, September 2023 sold 1 489 861 room nights for the month, when comparing this to September 2019, a total of 79 584 less room nights were sold compared to 2019, despite having a year-on-year growth of 52 554 room nights.

Due to the drastic average rate increase when compared to 2019 the room revenue compared to 2019 also showed an increase of 18.64% despite selling 79 584 less room nights. This indicates that currently hotels are the only winners when it comes to overall tourism driven by room nights sold.

When looking at the room night shortfall from January 2023 – September 2023 compared to that of 2019 over the same period, South Africa as a whole as now sold 230 048 less room nights than 2019, this indicates that other tourism entities that are relying on hotels to maximise room nights are still struggling – the CEO of TrevPAR World Group, Derek Martin says “We have seen on average that there is up to 3 people per room night sold into South Africa, with 230 048 less room nights sold it means that 690 144 less people have stayed in hotels in 2023 compared to 2019, the impact on the other sectors of the industry like Uber, restaurants, tourist attractions and operators are still struggling to achieve pre covid numbers, at this stage, the hotels are the only winners due to the increases in selling prices”

The data suggests that the hotel sector is comfortably back and driven by average rates despite selling less room nights higher revenues are being recorded resulting in higher profits despite being less busy, with Festive Season upon us, have you maximized your business yet?