Sample Size Overview

For the purpose of this study a sample size of 333 hotels based in Western Cape were used, the 333 hotels selected are based on the Western Cape Region category of STR.

The study looks at the forward online pricing of each of the 333 hotels as of 1 June 2020 until 30 April 2021, the pricing is based on double occupancy and is the lowest rate across Booking.com, Expedia and Agoda.

The purpose of this study is to determine how many of the 333 hotels are open, to what capacity they are open as well as to see at what the selling prices in the Western Cape Market are trending at for the next 12 months.

The sample size includes all-star graded properties together and does not represent any level category represented by star grading’s.

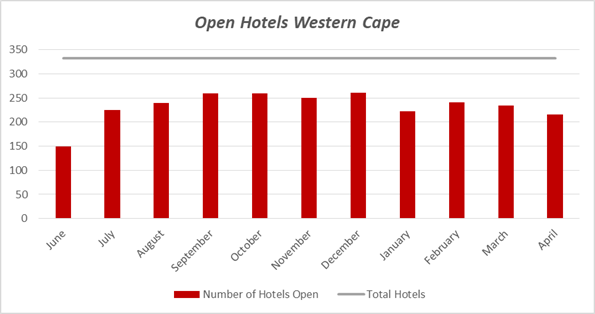

Open Hotel Ratio

When looking at the next 11 months on can see a clear trend as hotels start to reopen for sale across the online channels, with uncertainty in June whether hotels can open again only 48% of the hotels in the sample size where open for sale, in July this spikes to 66% and then August has 74% of the hotels open for sale.

From August through to February 74% of the hotels in the sample size are open for sale, this indicates that there are hotels in the sample size that is currently not for sale for an extended period of time, this could indicate permanent closures within the Western Cape Market.

March and April shows a decline in the number of hotels open for sale however this is not as a result of the hotel not being in operation but as a result of a distribution error, the basics of distribution indicates that a hotel must be bookable for at least 12 months in advance, some hotels in the sample are clearly not managing the distribution strategy of the hotels correctly.

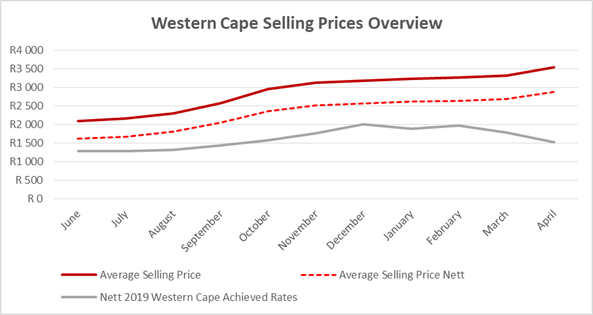

Western Cape Market Selling Prices

When looking at the selling prices across the Western Cape Market for the next 11 months an average selling price for 2 people including breakfast of R2 891.00, the lowest selling prices can be found in June at an average of R2 091.00, this is to be expected. The highest selling prices can be seen in April 2021 being R3 540.00 however this is mainly due to hotels not aligning their selling prices outside of the lead time.

Based on the study being gross selling prices, the nett rate comparison shows that based on the current selling prices the Gauteng Market will likely show a year on year average rate growth however this is not likely not be the end result as the lower demand may create panic and we may see hotels lower selling prices in hope of capturing any demand that may be booking.

When looking at the Western Cape Market pricing from January 2021 – April 2021 one can see a increase in the selling price even though the 2019 actual nett achieved rates indicate that this period last year the lower selling prices were the trend. This indicates that the market has not yet aligned the current selling prices to the seasonal trend and this would result in a loss of revenue generating opportunities for hotels that may be over-priced during this period.

This study shows that there is not much panic in terms of selling prices across the next 12 months even though we see that the amount of rooms for sale in the market gradually increases the closer to 2021 we move, it will only be a matter of time to see if this current “rate hold” trend continues as the financial pressure increases.

Will the low demand result in lower selling prices, will the hotels be that desperate to take occupancy and will it be worth it to open the hotel at these low occupancies, these are the very tough questions that we all need to start looking at now as its time for action to drive change.

What strategy will you implement?

We will be rolling out the same view per province as well as a roll up for the entire South Africa in the next few weeks.

Do you need help with your hotel pricing or understanding your direct competitors, let us know and we will happily assist, email us here. Alternative you can email as on info@Trevparwolrd.com